Inflation, high gas prices, COVID, disruption. There’s one common theme in deciding who wins and who loses in business. The business serving its customers best wins.

Inflation, high gas prices, COVID, disruption. There’s one common theme in deciding who wins and who loses in business. The business serving its customers best wins.

That’s the point of Thales Teixeira’s Unlocking the Customer Value Chain: How Decoupling Drives Consumer Disruption. You’ll learn insights into new ways start-ups and incumbents can disrupt the value chain and how incumbents can prevent disruption to theirs.

The central premise of the book is: KNOW YOUR CUSTOMER!

Teixeira provides examples of companies who successfully disrupted their own value chain and plenty of failures.

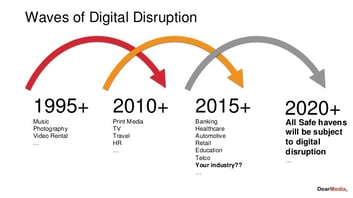

Digital disruption touches every industry setting enduring shifts in market dynamics. 1995 marked the beginnings of digital disruption which we’ve documented in previous blogs.

Digital disruption touches every industry setting enduring shifts in market dynamics. 1995 marked the beginnings of digital disruption which we’ve documented in previous blogs.

Does technology drive disruption?

Teixeira agrees with Jim Collins in Good to Great: technology doesn’t drive disruption. It accelerates it.

Teixeira believes disruption is due to a company’s failure to focus on what started the business, a focus on customers. If your business growth is stalled it’s lost its customer-centricity.

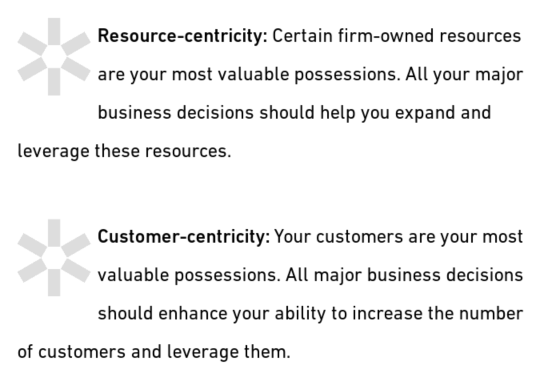

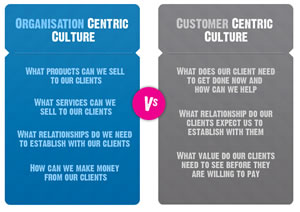

Resource-Centric or Customer-Centric

Success shapes executives’ views of their business. When incumbents spot a new opportunity or make changes that impact their current businesses, they first understand how any decision would impact their most valuable resource.

They ask: “Do we risk losing this resource?”

Whatever their resource, incumbents ask: “How can we leverage our most valuable assets to take advantage of the new opportunity?”

If the opportunity doesn’t mobilize the prized assets, the incumbent perceives it holds no advantage relative to others.

Consider why your business is being subjected to disruption.

Teixeira sees what he calls “resource-centric” perspectives as the prevailing attitude in many industries. As he explains, “Traditional retailers perceive stores as drivers of their revenues. Add more stores, and see revenues grow. Telecom operators perceive homes connected to their network as drivers of revenue. Add more homes, and see revenues grow…… Those resources attract paying customers, which the incumbent milks to exhaustion. That’s the incumbent’s moneymaking formula, and it’s reflected in the key metrics that executives in incumbent businesses use to make decisions: sales per square foot of store space, in the case of retailers; accounts or income per branch, in the case of retail banks; and revenue per mile of fiber-optic cable in the case of telecoms.”

Whereas start-ups, “Because they lack significant resources to attract customers, disruptors approach their business with a different mindset…… Uber didn’t have cars. Airbnb didn’t have hotel rooms. Netflix didn’t have stores. For disruptors, revenue growth originates in one place, and one place only: customer acquisition. If such acquisition requires an asset, then the disruptor might want to build, acquire, or borrow that asset from others…… disruptors don’t regard the asset as the end game. Regardless of the means to get those resources, startups milk resources to get customers, instead of milking the customers. Their mindset isn’t resource-centric but truly customer-centric. Just look at the metrics that startups commonly use; customer lifetime value, average revenue per user, and revenue per active customer.”

NETFLIX Example

Teixeira admires Netflix founder Reid Hastings. He suggests Hastings made the bravest strategic decision ever by a leader of a digital company in 2011. Netflix originally started by shipping DVDs by mail, growing tremendously, disrupting the industry, and hurting Blockbuster. As Netflix’s stock price and recurring revenues skyrocketed, the company did something seemingly crazy: it imploded its business model by moving to streaming.

“Hastings stayed the course (i.e.- streaming), and by 2017, the wisdom of his decision had become obvious. Streaming greatly surpassed the DVD-by-mail business. In the second quarter of 2017, Netflix had more than twelve times the number of streaming subscribers than it did DVD subscribers

“Hastings stayed the course (i.e.- streaming), and by 2017, the wisdom of his decision had become obvious. Streaming greatly surpassed the DVD-by-mail business. In the second quarter of 2017, Netflix had more than twelve times the number of streaming subscribers than it did DVD subscribers

Netflix’s decision reflects a deep and abiding customer-centricity on the part of Hastings and other company executives.

A traditional incumbent would have focused on its most valuable resources, an inventory of millions of DVDs, and multiple shipping and handling facilities around the country. But for a company streaming content online, those assets didn’t matter. In fact, they were worthless.

The new resource would have to include powerful servers, broadband bandwidth, and licensing agreements with Hollywood studios. The almost total divergence in strategic resources required for the two business models would have impeded the transition, if not for Hastings’s prescience and deep customer focus.”

Incumbents face difficult decisions. Yet the most pressing questions should always be, what will serve our customers best? What do our customers want and how can we serve them better?

Incumbents face difficult decisions. Yet the most pressing questions should always be, what will serve our customers best? What do our customers want and how can we serve them better?

By following what your customers want, you make decisions like Hastings made, no matter how difficult they are. As Peter Drucker noted, “The purpose of a business is to create and keep a customer.”

To create an environment where everyone is inspired to give their best, contact Positioning Systems today to schedule a free exploratory meeting.

Growth demands Strategic Discipline.

Growth demands Strategic Discipline.

Companies can evolve and innovate. Companies Are Not Customer-Centric; People Are. How to achieve innovation in your business requires overcoming resource centricity, either incentivizing employees or bringing in new people. We’ll explore the former and how companies like Intuit get their teams to constantly innovate next blog.

Building an enduring great organization requires disciplined people, disciplined thought, disciplined action, superior results, producing a distinctive impact on the world.

Building an enduring great organization requires disciplined people, disciplined thought, disciplined action, superior results, producing a distinctive impact on the world.

Discipline sustains momentum, over a long period of time, laying the foundations for lasting endurance.

A winning habit starts with 3 Strategic Disciplines: Priority, Metrics, and Meeting Rhythms. Forecasting, accountability, individual, and team performance improve dramatically.

A winning habit starts with 3 Strategic Disciplines: Priority, Metrics, and Meeting Rhythms. Forecasting, accountability, individual, and team performance improve dramatically.

Meeting Rhythms achieve a disciplined focus on performance metrics to drive growth.

Let Positioning Systems help your business achieve these outcomes on the Four most Important Decisions your business faces:

|

DECISION |

RESULT/OUTCOME |

|

PEOPLE |

|

|

STRATEGY |

|

|

EXECUTION |

|

|

CASH |

|

Positioning Systems helps mid-sized ($5M - $250M+) businesses Scale-UP. We align your business to focus on Your One Thing! Contact dwick@positioningsystems.com to Scale Up your business! Take our Four Decisions Needs Assessment to discover how your business measures against other Scaled Up companies. We’ll contact you.

NEXT BLOG – “Licking the Cookie” Companies Are Not Customer-Centric; People Are

NEXT BLOG – “Licking the Cookie” Companies Are Not Customer-Centric; People Are

.jpeg?width=150&height=135&name=Hand%20with%20marker%20writing%20the%20question%20Whats%20Next_%20(1).jpeg)