%20Jet%20Engine.png?width=207&name=Growth%20Sucks%20CASH%20(CCC)%20Jet%20Engine.png) GROWTH SUCKS CASH!

GROWTH SUCKS CASH!

If you’re business is growing, you know the truth of this statement.

In our private and public workshops, we use this airplane engine graphic to illustrate this.

In our last blog Your Organization’s Most Important Resource we looked at improving your company’s CASH through the lens of Labor Efficiency Ratio.

The result of getting the Cash Decision right in your business is oxygen and options. When a baby is born, love is like oxygen. In a business, cash is oxygen. It also offers a company many options on how and when to use its Cash.

A CHILD’S GAME FOR REAL

You’ve probably played the game of Monopoly. Either as a child, with your children, or grandchildren.

Running a business is just like playing Monopoly: When you run out of cash, it makes it nearly impossible to continue to operate your company. Game over!

If you’ve ever ran your business when you’re short cash you know exactly how difficult it is. It’s difficult to think of anything else. Strategic thinking, even tactical thinking is a challenge, because you’re always thinking about where your money is coming from, when it’s coming, who you must pay, and when you have to pay them.

Distracting is a mild word to describe what running a business that’s short on cash.

GROWTH & PROFITABLITY = LIQUIDITY

GROWTH & PROFITABLITY = LIQUIDITY

Look at the diagram on the left. It has 2 sides (Growth and Profitability) supported by a foundation (Liquidity). Without any one of these key elements, the others collapse.

Here’s the Key point: It takes Profitability to create Liquidity (Foundation). Once you build this foundation (Liquidity), it allows you to grow (Growth). It is momentum that travels like a clock, Growth with Profitability = increased Liquidity, which fuels Growth, which, if profitable, provides more Liquidity and the momentum continues.

It’s why it is so important not only to grow, but to grow profitably. There are many examples of companies that grew either too fast or had growth in Revenue but not Profit and they ran out of gas… cash… liquidity… and they died.

Any time one of the 2 side elements break down, the momentum stops and the foundation starts to crumble.

But you know this, don’t you? CASH CONVERSION CYCLE

CASH CONVERSION CYCLE

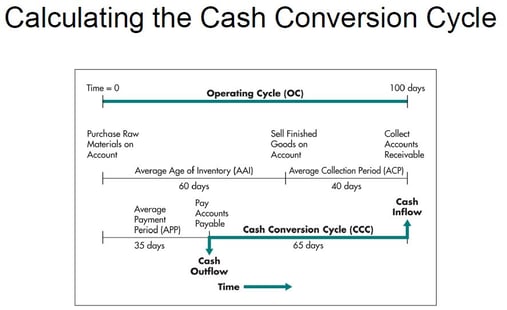

The cash conversion cycle, also called the net operating cycle, is the number of days it takes a company to generate revenues with assets. The cash conversion cycle is a measure of how long an investment is locked up in production before turning into cash.

The Cash Conversion Cycle is the amount of time it takes to go from a sales proposal to getting paid for that order. Think of it like a football field. One goal line represents the sales proposal, and the other represents receiving the payment. There are 100 yards in between. What we are trying to do is shrink that 100 yards down.

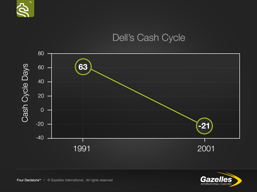

Example: In the early 1990s Dell was running out of cash (while it was growing). They hired Tom Meredith as their CFO and one of his missions was to increase Liquidity (Cash). When he took over in 1991 their Cash Conversion Cycle was at 63 days. As you can see on the graph, when Tom retired in 2001 he had reduced their CCC to -21 days – yes, that’s a minus. He did this by streamlining his manufacturing, working with his suppliers, and by getting his customers to pay for their product up front. Think about the last time you bought a Dell computer. You order it online, you give them your credit card, and they take your money before they ever even enter the order into their system.

Example: In the early 1990s Dell was running out of cash (while it was growing). They hired Tom Meredith as their CFO and one of his missions was to increase Liquidity (Cash). When he took over in 1991 their Cash Conversion Cycle was at 63 days. As you can see on the graph, when Tom retired in 2001 he had reduced their CCC to -21 days – yes, that’s a minus. He did this by streamlining his manufacturing, working with his suppliers, and by getting his customers to pay for their product up front. Think about the last time you bought a Dell computer. You order it online, you give them your credit card, and they take your money before they ever even enter the order into their system.

I worked with a packaging supplier for Dell for a short time. Dell required shipping boxes be recieved the next day by 9 AM. Dell emailed orders by 4 PM the day of. They paid this supplier in 60+ days.

Since 2001 Dell has continued to streamline its processes and in 2006 had a CCC of -39 days.

.jpg?width=257&name=CASH%20-%20Cash%20Conversion%20Cycle(IP).jpg) A typical Cash Conversion Cycle looks like the diagram here. There are 4 elements to the CCC: Sales, Make/Production & Inventory, Delivery, and Billing & Payment. You need to start thinking about ways to accelerate cash in all of these 4 areas. And YES, you all have ways to improve cash by working through a CCC for your company. By understanding your Cash Conversion Cycle, you can employ cash acceleration strategies to increase your cash flow.

A typical Cash Conversion Cycle looks like the diagram here. There are 4 elements to the CCC: Sales, Make/Production & Inventory, Delivery, and Billing & Payment. You need to start thinking about ways to accelerate cash in all of these 4 areas. And YES, you all have ways to improve cash by working through a CCC for your company. By understanding your Cash Conversion Cycle, you can employ cash acceleration strategies to increase your cash flow.

IMPROVE ALL FOUR AREAS OF CCC EXERCISE

In most companies the effort to improve Cash focuses on the Billing and Payment area. The Cash Conversion Cycle exercise helps any business discover areas to make dramatic improvements. Each of these four areas can be improved by:

- Eliminate Mistakes

- Shorten Cycle Times

- Improve Business Model

One of my customers received dramatic improvements by shortening their cycle times. (Their collections department expected payment by the 10th of the month, yet weren’t following up until 40 days. Result: A consistent short fall in cash was eliminated permanently.) They also improved their business model increasing sales by 35-55% in the next six months (Their software had been on DOS. Switching it to Windows platform jumped sales dramatically!)

Another customer changed their sales process, increasing their closing ratio from 33% to 66%. This 100% improvement dramatically surged their cash flow!

.jpg?width=507&height=665&name=CASH%20-%20Cash%20Conversion%20Cycle%20(IP).jpg) We recommend our customers complete this exercise annually to uncover avenues to increase cash flow.

We recommend our customers complete this exercise annually to uncover avenues to increase cash flow.

Looking for help with your business’ CASH flow? Contact dwick@postiioningsystems.com for help or a free Needs Assessment of your business.

NEXT BLOG – CASH FLOW STORY

Every business has a cash flow story.

In Dan & Chip Heath’s book, Switch: How to Change Things When Change is Hard they suggest, “Select small wins that have two traits: 1) They’re meaningful 2) They’re “within immediate reach.’ And if you can achieve both traits, choose the latter.”

We’ll look at how small, almost insignificant change can dramatically affect your PROFIT and CASH flow. Next blog The Power of One.

.jpeg?width=150&height=135&name=Hand%20with%20marker%20writing%20the%20question%20Whats%20Next_%20(1).jpeg)