If you’ve been following our blogs on Confessions of the Pricing Man: How Price Affects Everything by Hermann Simon you’ve been learning about the huge leverage that pricing can have on your company’s profitability.

If you’ve been following our blogs on Confessions of the Pricing Man: How Price Affects Everything by Hermann Simon you’ve been learning about the huge leverage that pricing can have on your company’s profitability.

Simon points out that price setting requires a thorough understanding of two things:

- how your customers perceive your value

- the profit level you need to sustain or improve that value

What’s your goal for your business? Is it market share?

If market share is your primary goal, why don’t you just give away your product for free? Or even pay customers to use it?

This strategy makes no sense.

Goal setting in almost all companies is not an “either-or” exercise. Balance is paramount. When we do planning with our Gazelles coached businesses we stress the need for One Priority and then a Counter Balance. Always we stress the importance of balancing productivity and people.

The problem Simon shares? Most companies are not balanced. They underemphasize profits relative to such goals as market share, revenue, volume, or growth.

They misunderstand the often dire consequences in this prioritizing. This imbalance results in bizarre pricing strategies and ineffective marketing tactics.

Amazon Pricing Strategy

Simon shares this analogy: Does Amazon want to grow revenue forever without sufficient profit margins? Shareholders continue to believe in the strategy. In 2015 Amazon’s share price increased by more than 50%. But eventually even Amazon must turn a profit. What sense do the results of a ceramics company make which for the year 2013 reported revenue growth of 4 % and a profit decline of 28 %? As Amazon, this company priced its products very aggressively. Very often, questionable pricing is one of the root causes when revenue increases and profit declines.

Simon shares a chart in the book on how the profits of selected companies from the Global Fortune 500 change, if they raised their prices by 2%? The changes in profits are for 25 companies, based on data for their 2012 financial years.

Even this relatively small price increase of 2% has a dramatic effect on the profits of many of these companies. Here are some of the examples he gives:

- If Sony succeeded in raising its prices by 2 % without any loss of volume, its profits would increase 2.36-fold; that is, they would more than double.

- The profit increase for Walmart would be 41.4 %, and for

- General Motors 36.8 %.

- Even highly profitable companies such as Procter & Gamble, Samsung Electronics, or Nestle would see profits grow by more than 10%.

Even the most profitable companies, IBM and Apple, would see more modest but still significant profit increases. The numbers clearly demonstrate that it pays to optimize prices.

Three Profit Drivers

Revenue is the product of price and volume. Profit is the difference between revenue and cost. This means that every business has only three profit drivers:

- price

- volume

- cost

All of these profit drivers are important, but they affect profit to different degrees.

Simon offers his own anecdotal evidence, studies, and experience. Managers dedicate most of their time and energy to cost cutting—you could alternatively call it “efficiency improvement”—as a means for increasing profits, especially in tougher economic times.

Simon’s estimates - managers allocate 70% of their time to cost issues, 20% to volume, and only 10% to price.

The second most “popular” profit driver among managers is volume or unit sales. Managers are willing to invest in better sales tactics and support, building their sales forces, and refining their competitive strategies.

Price typically comes in last place, and in some cases comes into consideration only as the handmaiden of managers waging a price war.

Here’s the irony. This prioritization runs in the opposite order of the effects these drivers have on profits.

Prices get the least attention, but have the greatest impact.

PRICE DRIVES PROFIT EXAMPLE

Simon provides an example of a company that makes and sells power tools. “The numbers derive from a Simon-Kucher & Partners project, but I have rounded and altered them to make the math simpler. It costs $60 to make the tool, which is sold to dealers and wholesalers at a price of $100. The fixed costs are $30 million. The company currently sells one million power tools per year. This turns into revenue of $100 million and total costs of $90 million. Thus, the company earns a profit of $10 million and a good margin of 10%. The cost structure of this case is somewhat typical of industrial products.

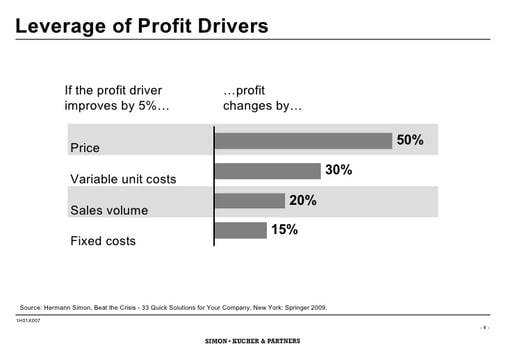

Now let’s look at what happens if we improve each of the profit drivers—price, variable costs, volume, and fixed costs—by 5 % in isolation.

- A price increase of 5% boosts profits by 50%.

- A 5% increase in volume, in contrast, increases profits only by 20%.

- Profit improvements from 5% reductions in variable costs and fixed costs come in at 30% and 15%, respectively.

Improving any of these profit drivers has a significant impact, which makes it worthwhile to invest in them. The point is that improving prices has the greatest leverage on profits. It’s a power which managers typically underestimate.

Improving any of these profit drivers has a significant impact, which makes it worthwhile to invest in them. The point is that improving prices has the greatest leverage on profits. It’s a power which managers typically underestimate.

In contrast to this is what happens when you cut prices. Suppose you cut prices by 20%. How many power tools in the example above would you need to sell to achieve the same level of profit in the above example? Managers typically respond by saying 20% more. Yet that number is far below the volume you need.

We’ll explore the effect of cost cutting on profits next blog.

.jpeg?width=150&height=135&name=Hand%20with%20marker%20writing%20the%20question%20Whats%20Next_%20(1).jpeg)