Our last several blogs have discussed the importance of four critical decisions and the role they play in the success of your business. Decisions equal success – and there are four decisions, in growing your business, that you must get right or risk leaving significant revenues, profits, and time on the table. These four decisions are: People, Strategy, Execution, and Cash. Even though most growth firms face continual challenges in all four areas, at any one time the challenges in one of these areas overshadows the rest. Therefore, your first decision is to choose which one of the four to focus on next.

-resized-600.jpg?width=324&height=217&name=cash_-__four_decisions_(ip)-resized-600.jpg) Cash is probably the one Decision that absolutely overshadows all of the others when it isn’t working in your business. It’s not to say it is always most important, it’s simply that when your business is short of cash, when you’re operating day to day, wondering if you have the funds to pay bills or cover payroll, nothing is more important or preoccupies the mind of the leadership team, particularly the owner. You become so absorbed with cash, what your balance is each day, sometimes even every hour, you don’t have the capacity to think of anything else. Cash, when it’s short, consumes every business owner.

Cash is probably the one Decision that absolutely overshadows all of the others when it isn’t working in your business. It’s not to say it is always most important, it’s simply that when your business is short of cash, when you’re operating day to day, wondering if you have the funds to pay bills or cover payroll, nothing is more important or preoccupies the mind of the leadership team, particularly the owner. You become so absorbed with cash, what your balance is each day, sometimes even every hour, you don’t have the capacity to think of anything else. Cash, when it’s short, consumes every business owner.

In our Public and Private workshops we ask how many of the attendees have played the game Monopoly? Why? Because running a business is just like playing Monopoly: When you run out of cash, it’s impossible to continue to operate your company. Game over!

You need to explore the importance of cash and ways to improve your cash position because cash is like oxygen is to your body, without it you cease to exist. Wouldn’t you like to improve your cash position?

Let’s examine several of the Cash Growth Tools that can elevate the cash flow of your business and allow you to concentrate on the other decisions that can significantly grow your business.

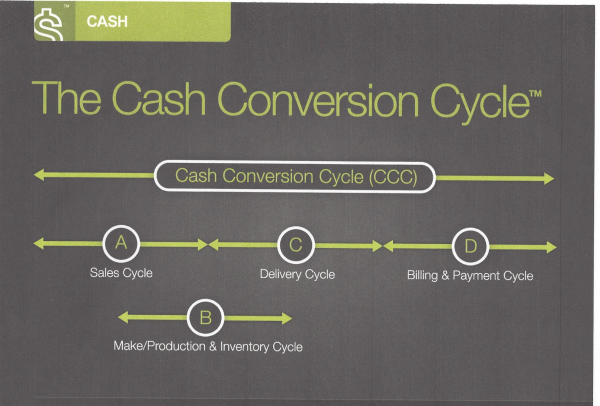

Cash Conversion Cycle: The first law of entrepreneurial gravity is “Growth Sucks Cash.” We encourage companies to calculate their Cash Conversion Cycle (CCC) -resized-600.jpg?width=341&height=231&name=cash_-_cash_conversion_cycle(ip)-resized-600.jpg) which measures companywide how long it takes between when you spend a dollar (marketing, design, rent, wages, etc.) until you get that dollar back.

which measures companywide how long it takes between when you spend a dollar (marketing, design, rent, wages, etc.) until you get that dollar back.

In the early days of Dell, Dell’s Cash Conversion Cycle was running 63 days. Michael Dell and his company had almost run out of cash. By focusing on decreasing this cycle, today they are running somewhere in the neighborhood of minus 45 days. This means they generate more cash the faster they grow. This is why Dell had over $9 billion in the bank, up from $6 billion when they got in trouble. We believe all growth firms can accomplish this or at least dramatically improve their CCC giving them sufficient internal cash to fuel their growth. I suggest executives read Neil Churchill’s famous HBR article entitled “How Fast Can Your Company Afford to Grow” which provides the formulas for calculating your cash conversion cycle. You may wish to explore our blog Cash – How Fast Can Your Company Afford to Grow? in which I provided an Excel tool to help you discover this.

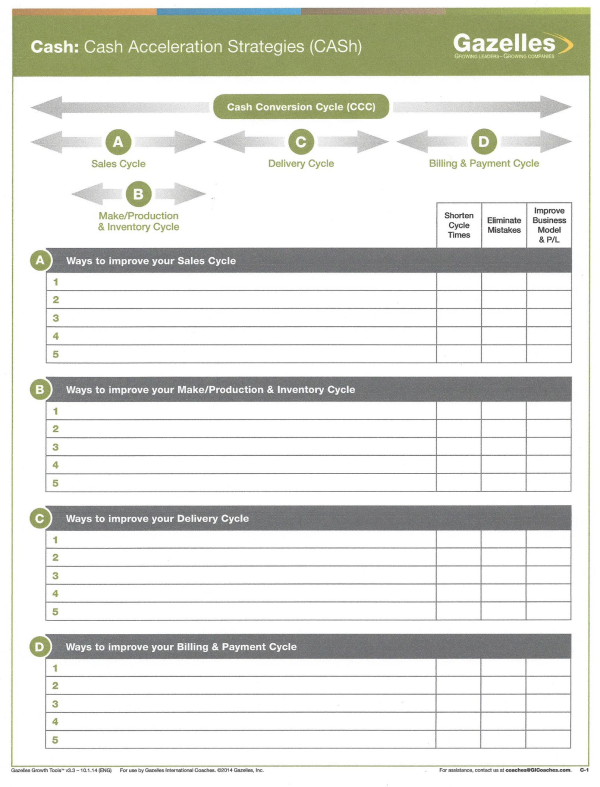

There are 4 elements to the CCC: Sales, Make/Production & Inventory, Delivery, and Billing & Payment. -resized-600.jpg?width=312&height=409&name=cash_-_cash_conversion_cycle_(ip)-resized-600.jpg) What you want to do is start thinking about ways to accelerate cash in all of these 4 areas. And YES, you all have ways to improve cash by working through a CCC for your company. By understanding your Cash Conversion Cycle, you can employ cash acceleration strategies to increase your cash flow. (You have probably done this exercise if you attended a Rockefeller Habits Workshop, although this is always a good one to revisit to discover more opportunities to help provide cash in your business.)

What you want to do is start thinking about ways to accelerate cash in all of these 4 areas. And YES, you all have ways to improve cash by working through a CCC for your company. By understanding your Cash Conversion Cycle, you can employ cash acceleration strategies to increase your cash flow. (You have probably done this exercise if you attended a Rockefeller Habits Workshop, although this is always a good one to revisit to discover more opportunities to help provide cash in your business.)

Four Forces of Cash flow model; Greg Crabtree, author, business owner, and Gazelles faculty member (Greg co-authored the chapter on “Cash” in “Scaling Up”) developed the Four Forces of Cash flow model after working with hundreds of entrepreneurs, and learning from their challenges and successes.

The Four Forces of Cash flow are the four basic foundational attributes needed to have a financially stable, solid growth company. They are:

• Tax Provision: Set aside sufficient cash to make quarterly tax payments to end the quarter at as near as possible to zero tax liability. True wealth is created through wise investment of after-tax profits, so planning and provisioning cash for taxes is vital;

One of Greg’s most important learning points through time is that business owners often distort the true reality of their cash flow and foundation for growth by manipulating variables to save on tax liability, interest expense and other secondary considerations.

THE primary consideration (objective) is to show a true, real picture of the state of a business’ cash position, AND then build a foundation of strength through a sequence of management actions, resulting in harvesting profits and building wealth. Look first at what Greg calls “removing the distortions.” If a company is generating $20M or less each year in revenue, the compensation of owners working in the business and shareholder distributions can distort the true state of the business’ profitability. If the owners are NOT taking fair market wages and are taking excess distributions, their profit may be considerably lower than what they are reporting and think it is! (And you may be headed for trouble without knowing it.) By ensuring that owners take a fair market wage for their services rendered to the company and then follow a specific sequence to harvest profits (more on this shortly), they are intentionally and methodically building an enduring financial foundation for growth.

Once owner fair market compensation and proper distributions are calculated and categorized, then the Forces of Cash Flow can be sequentially built upon to the point of building wealth. Remember, take a longer view of success (years, not just months or quarters) and this intentional approach will yield not only financial success, but also more time and peace

• Debt Management: Eliminate short-term debt at the end of each quarter (pay down your operating line of credit) and remain current on any long-term loans;

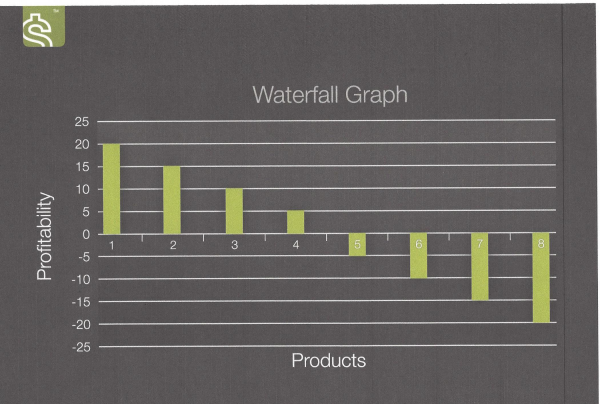

Sometimes as business leaders we get so focused on planning and/or the day-to-day execution of the business that we forget to ask a very simple question to guide our success: “What 20% of our Products (or Customers, Locations, Sales Reps, etc.) are producing 80% of our Gross Margin dollars?”

A simple application of the Pareto principle periodically can make a world of difference – eliminating money losers, investing more into money makers, and improving those in between. Let’s look at a specific visual tool useful for Profitability Analysis

• Core Capital Target: Once you have paid your taxes and short-term (quarterly) debt, build a cash buffer in order to be fully capitalized. A good Core Capital Target to achieve is two months-worth of operating expenses in a special Core Capital account that goes untouched. In calculating your Core Capital Target, the only costs you exclude from monthly operating expenses are your Costs of Goods Sold (since you typically can secure 30-day terms);

Data without context, analysis and visual depiction often remains just that: data (not acted on). When we use analytical tools and graphs to provide visual context and patterns with data, it is much easier to act on. Depicted on the right is a Waterfall Graph -resized-600.jpg?width=402&height=270&name=cash_-_waterfall_chart_(ip)-resized-600.jpg) that has a Profitability Key Performance Indicator (KPI) on the Y (vertical) axis and a key driver of profitability on the X (horizontal) axis, In this example Product Lines, but it could also be Customers, Locations, Sales Reps, or Distribution Channels. Here the “profitability by key driver in a series” is depicted so that the leadership team can further investigate and make important decisions about improving, terminating or accelerating the corresponding drivers (based on their profit contribution).

that has a Profitability Key Performance Indicator (KPI) on the Y (vertical) axis and a key driver of profitability on the X (horizontal) axis, In this example Product Lines, but it could also be Customers, Locations, Sales Reps, or Distribution Channels. Here the “profitability by key driver in a series” is depicted so that the leadership team can further investigate and make important decisions about improving, terminating or accelerating the corresponding drivers (based on their profit contribution).

We have found through experience that the Pareto principle is very much alive and well in mid-market growth companies: 80% of profit is driven by 20% of a series of key drivers (for example: 80% of profit is driven by the top 20% of product lines). We recommend that growth companies build Waterfall Graphs on a regular basis for Products, Customers, Locations, Distribution Channels and/or Sales Reps

• Dividend Profits: Harvest Profits by paying Dividends to shareholders and paying bonuses to deserving team members who helped get you to this point!

We’ve looked at two of the Cash Decision Growth Tools this blog. Ahead still are Labor Efficiency Ratio , Your Cash Flow Story, Fundability Optimization and Increasing Equity. We’ll look at the first two next blog.

.jpeg?width=150&height=135&name=Hand%20with%20marker%20writing%20the%20question%20Whats%20Next_%20(1).jpeg)