In Fred Reichheld’s first book The Ultimate Question introducing Net Promoter Score, the standard for gauging Customer Satisfaction, he spoke about a specific issue that many companies have deriving what he called “bad profits” from their customers.  An example he gave at the time was staying at a hotel and having to use the phone from your room to make call. At the time of the book’s publishing many hotels were charging exorbitant fees to call, especially long distance calls.

An example he gave at the time was staying at a hotel and having to use the phone from your room to make call. At the time of the book’s publishing many hotels were charging exorbitant fees to call, especially long distance calls.

For more on the value of NPS, and how much customer loyalty means to grow your business read Growth Summit cont Fred Reichheld The Ultimate Question – Customer Advocacy

I’d like to share a personal story about “Bad Profits” with my bank Wells Fargo that I believe is an example of how their interest is more avarice than customer oriented.

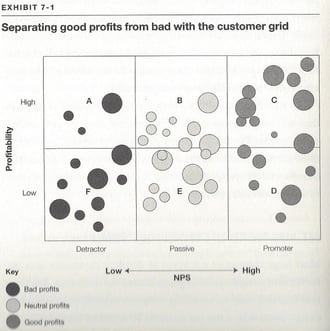

First let me share a grid from The Ultimate Question that might help you separate where good profits and bad profits exist. Take a look at the picture on the left. It’s scanned directly the book The Ultimate Question since I couldn’t find a picture of it online. The vertical axis indicates customer profitability - the higher on the axis, the more profitable. The horizontal line bisecting the grid separates high-profit from low profit customers. Reichheld notes that the best threshold for this line is the point where returns match your company’s cost of capital. This allows you to know customers above the line are actually generating shareholder/business owner value.

The horizontal axis shows customers’ status regarding the NPS or Ultimate Question. Detractors are to the left, passives in the middle, promoters are on the right.  You see vertical lines to separate the three categories. Reichheld suggests if you do this for your company add a dotted vertical line at the average NPS for your industry, or separate lines for each competitor. (This may take some research and even purchasing the information from https://www.netpromoter.com/

You see vertical lines to separate the three categories. Reichheld suggests if you do this for your company add a dotted vertical line at the average NPS for your industry, or separate lines for each competitor. (This may take some research and even purchasing the information from https://www.netpromoter.com/

Plot circles in each sector to indicate your costumers or customer segments. Make the circles proportional to the revenues each group brings in. With this grid you can visually see the real health of your company’s growth engine.

Here are some conclusions you can draw should you do this exercise with your customer satisfaction data. (Taken directly from Page 121 of The Ultimate Question):

- If most of the circles fill the left-hand side of the grid – and particularly if they’re up there in sector A – the diagnosis is clear. You are addicted to bad profits. You have been milking your customers, and they will leave at the earliest opportunity. As you can see the grid applies the notion of bad profits to specific customer accounts. Any profits earned from customers how show up in sectors A or F are bad and need attention. (Bain found that he best companies have less than 10 per cent of their customers located in these two segments together – sometimes even less than 3 percent.)

- If most of the circles are in the right-hand side – particularly if they’re in the upper right (Sector C) – the preponderance of your profits are good profits and you’re in great shape. (Humorously Fred wrote – In fact let us know so that we can invest in your company.) Top firms typically have from 55 to 85 percent of their customers in sectors C or D.

- If most circles are in the middle - sectors B and E – well, join the club. That’s the standard pattern. Your customers don’t really love you, but they don’t hate you either. They’ll stick around until something better comes along. Meanwhile, you’re making at least some money, particularly from customers in sector B.

For those of you still unfamiliar with the NPS Score and the Ultimate question I’m including a picture of the NPS calculation and question on the right.

For those of you still unfamiliar with the NPS Score and the Ultimate question I’m including a picture of the NPS calculation and question on the right.

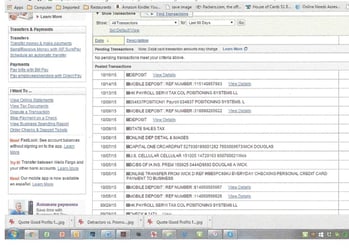

All this leads me to an encounter I had with my current bank Wells Fargo. The convenience of checking your transactions on line, transferring funds and making mobile deposits on your phone has certainly changed the banking industry. It’s convenient to simply go to your account online. In many cases I simply don’t have my checkbook with me when I checking my transactions. If you look at the picture of my online transactions you will see a small description after several transactions View Details.

This is for deposits, mobile and others, plus checks written.  The link represents this convenience to simply check what it is. Evidently the first time you click this, a pop up window opens to indicate you will be charged a fee for viewing the details. The curious thing about this, after you’ve done this once this popup reminder no longer comes up. Evidently Wells Fargo believes you should be able to remember this every time you click on View Details.

The link represents this convenience to simply check what it is. Evidently the first time you click this, a pop up window opens to indicate you will be charged a fee for viewing the details. The curious thing about this, after you’ve done this once this popup reminder no longer comes up. Evidently Wells Fargo believes you should be able to remember this every time you click on View Details.

I’m not sure about you, but to place this enticement in the transaction page alone suggests to me someone knew exactly what they were doing in order to get customers to click on it. Yet to not inform customers that they will be charged ($3.21 in my case) each time to me is the height of avarice and greed! I have the same opportunity on my Capital One Credit Card, yet I’m not charged to look at the details.

Am I being naïve? How would you feel if each time you checked the details on a transaction like this you were charged $3.21? Is this true of your online bank statement for your bank?

The whole process feels wrong to me. Several times I’ve requested my personal banker from Wells (He’s in Arizona!) look into this and the last message I received from him was, “I’m sorry you feel that way. We don’t want to lose your business, but unfortunately these are fee’s assessed by Wells Fargo.”

I’m looking into a new financial institution. One that is not so mercenary and deceptive in their practices. Am I wrong?

I’m traveling today to Dallas for the Fortune/Gazelles Growth Summit. I’ll be there Tuesday and Wednesday collecting best practices and ideas from the Top Thought leaders including Mark Cuban. This year two of my customers are joining me so my time may be limited to write. Hope to share a topic or more in my Thursday blog. If possible I hope to blog each day from the Growth Summit.

Just a reminder for 2016 businesses planning please consider attending our November 11th Scaling Up Workshop in Cedar Rapids, IA.

.jpeg?width=150&height=135&name=Hand%20with%20marker%20writing%20the%20question%20Whats%20Next_%20(1).jpeg)