Watching my customers achieve a theme, their One Thing for the Quarter or year is an extremely rewarding part of being a Gazelles Coach/Consultant. The pinnacle of that experience is watching your customer sell his business and be genuinely rewarded in the process for his tireless efforts and energy to do what is right for his employees and staff as well as himself.

Watching my customers achieve a theme, their One Thing for the Quarter or year is an extremely rewarding part of being a Gazelles Coach/Consultant. The pinnacle of that experience is watching your customer sell his business and be genuinely rewarded in the process for his tireless efforts and energy to do what is right for his employees and staff as well as himself.

There are a lot of business owners in the baby boomer era reaching retirement age and looking soon to divest of the businesses they’ve created. A recent article By Verne Harnish, “Growth Guy” (author of Mastering the Rockefeller Habits) in Fortune Magazine offers tips on the tricks buyers can play. Entrepreneurs work years building up the value in their business only to give a big chunk of it away when it comes time to sell. Why? Savvy corporate acquisition teams have a prescribed method for wearing down the most seasoned entrepreneurs, backing them into a corner where they have to sell for a steep discount.

It doesn’t have to be that way. In reality a sale can go extremely well when you’re prepared and follow the advice of good advisors. In addition you can prepare your business for a high return by investing in the business now and making it more attractive to a prospective buyer.

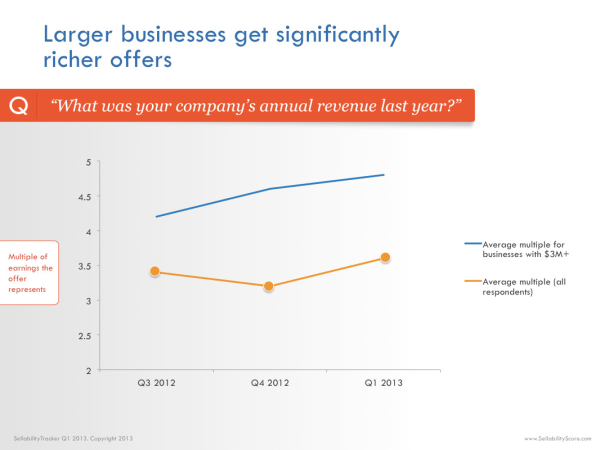

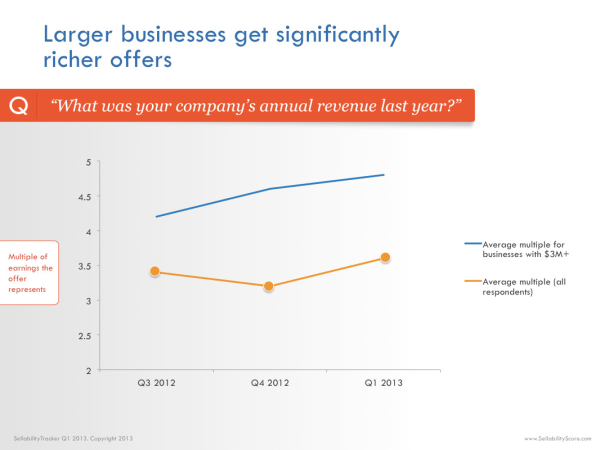

In fact recent indicators (Why the value of your business is going up)-resized-600.jpg?width=277&height=207&name=going_up2_larger_business_richer_offers_(built_to_sell)-resized-600.jpg) show that average multiple being offered to business owners is trending upwards.

show that average multiple being offered to business owners is trending upwards.

The news is better for businesses with at least $3 million in annual revenue whose average multiple is now closing in on five times Earnings Before Interest Taxes, Depreciation and Amortization (EBITDA).

Here’s a real life example of a local business owner who sold his business to offer some insight and perspectives on how things can go well when you get a legitimate inquiry that turns into an opportunity to sell. The purchaser, their company name and the company they purchased requested we keep their names confideintial. Please forgive this inability to give you specific names. It should not diminish the value of this example of following a positive process for selling your business.

A former client of mine sold his business a few years ago and can give some insight and perspective on how things can go well when you get a legitimate inquiry that turns into an opportunity to sell.

In order to respect his privacy and the non-disclosure agreement between him and the purchasing company we will keep his name and the purchasing company’s name private. Let’s just call him Jim and the purchasing company ABC Corp.

Jim initially received an inquiry about two years prior to his business sale closing. They had specific interest in his company since it was vertically niched to their industry. The persistence in their approach was consistent. They would contact Jim and then go away for a month or two but would always come back with more questions.

During this time Jim worked with Positioning Systems Business Development and Coaching firm immersing the best practices and top thought leadership from Gazelles Mastering the Rockefeller Habits. The focus on strategic planning and specifically a process called Strategic Discipline built a routine, structured, systematic pattern that had been lacking in the business. The result was a cadence of accountability within their leadership team, committed to annual, quarterly, monthly, weekly, and daily huddles focused Priorities, Metrics and Meeting Rhythms.

GROW YOUR BUSINESSES’ REPUTATION

One of the immediate benefits of the Quarterly Strategic Planning Process was a step up in customer service. Jim’s company’s customer service rating showed a very significant improvement in the very first quarterly theme. It was a remarkable effort that indicated how powerful focusing on One Thing can be. An industry expert noticed the outstanding service which directly led to a prominent trade show display providing the catalyst for a 25% growth rate the subsequent year. This despite being in a mature industry segment.

ABC Corp., as a suitor, could see this reputation Jim’s company was building. They were focused on how the company would add to their profit if purchased. The opportunity in customer service excellence offered an area to achieve this significantly. We’ll see how ABC Corp’s proprietary experience in their market helped them to significantly increase Jim’s company’s profit margin.

Now things began to get interesting. Before agreeing to accept a letter of intent, Jim wanted to be sure of 2 things. First, he wanted to understand the tax implications of any offer so he spent considerable time with his accountant to understand the tax liabilities. This is an important matter to consider as the income tax can make a significant impact on how much money the seller actually receives. Also, the taxes can vary a lot depending on whether the transaction is an asset purchase or a stock purchase. So, make sure you understand this very well.

NO SURPRISES

The second thing Jim wanted to be sure of was that there were no surprises when it came time for due diligence. Due diligence can be very time consuming and can open a can of worms if the purchaser finds something that would be detrimental to purchasing the company. Keep in mind, that during due diligence you are legally required to divulge anything and everything about your company, even if it is negative. So, Jim chose to discuss considerable detail with the purchaser about his company, especially those things that he thought might jeopardize the sale. “Show the purchaser all your pimples. Don’t hide anything,” says Jim. In addition, he requested as much detail as possible about the terms of the purchase from ABC’s perspective. Once these details were out in the open, then Jim felt comfortable that signing a letter of intent would in fact result in the sale being consummated without major problems. Gathering these details also gave Jim information to discuss with his accountant and attorney.

Jim did not use the services of a broker. He had been negotiating with two, however when ABC made what was a fair offer he backed out of looking at a broker. ABC was right in the ballpark of what the brokers were estimating so he didn't feel he needed to work with a broker at that point.

Jim doesn’t recall a specific discussion of EBITDA, but of course they looked at some form of that. “They always want to look at earnings before interest, taxes and amortization, also, depreciation. So they definitely were looking at those types of numbers, but not exactly in that form.”

Looking back on the sale Jim still feels very good about it to this day. The company has remained in the same location, many of the employees remaining and flourishing, although there was some minor attrition due to the changes and some corporate adjustments in functions. Several of the company’s people have stepped into more responsibilities and the company is enjoying continued growth and success, allowing them to earn more responsibility and earning capacity. It’s good to feel the employees he hired, nurtured, and trained are doing so well.

HIDDEN OPPORTUNITY

If there was one area Jim had reluctance addressing at times it was the cost to his customers of ongoing customer service. Early on as a consultant we worked to get his customers to pay on time for support. We often discussed increasing the fee structure for their monthly support; however Jim felt uncomfortable raising this structure perhaps out of fear of losing customers and revenue. As it turns out with their growing reputation he could have doubled his support fees and not had much attrition.

In fact ABC did exactly that the following year providing a substantial profit base for the business. Jim’s company had previously relied on new software sales to generate most of its profit each year.

That doesn’t diminish at all how Jim feels about his sale. The comfort of completing it quickly, offering his employees the opportunity to keep their jobs and be providing greater opportunity, only is minimized by the rewarding feeling of having built something that someone else saw as having significant value to others.

Considering selling your business in the near future From Verne Harnish’s Fortune article, here are some of their dirty tricks to watch for from buyers.

PROMISES, PROMISES

The first step is counterintuitive, which is why it’s so effective. The buyer offers the entrepreneur an insanely large price for the business and suggests the deal can close in weeks.

The offer--always expressed as some multiple of EBITDA, to condition the entrepreneur to become overly sensitive to expenditures--will be a price that is 50% to 200% more than what even the entrepreneur thinks the business is worth. It looks like the deal of the century.

Why would buyers do this? To get entrepreneurs to drop their guard. Nothing builds a temporary relationship faster than offering a premium price for the business. I say “temporary,” because entrepreneurs are not likely to stick around after the sale.

It also gets entrepreneurs and their spouses dreaming about the life they’ll lead after the sale – the houses, boats, and vacations – and planning for what they’ll do once they have a boatload of money.

More importantly, buyers do this to entice sellers to sign an exclusivity agreement that prevents them from talking with other potential buyers for six months during the due diligence period – which they promise will go quickly. Entrepreneurs will usually sign on the dotted line, relieved that they are going to get a great price—even if it is ultimately half of what’s offered--and not have to deal with other buyers--which is extremely time consuming. But that’s the beginning of their downfall.

POWER PLAYS

Once the document is signed, buyers will drag out due diligence for months, while promising that everything should be wrapped up shortly. If I had a nickel for every time an entrepreneur heard “It’s just a couple weeks more” we could all retire.

And as due diligence gets dragged out, because the buyer tied the selling price to some multiple of EBIDTA, the CEO starts putting off key expenditures that she would otherwise make to keep the business humming along – a key hire or media purchase or training session.

PSYCHOLIGICAL WARFARE

To make matters worse, the buyer starts disrupting the entrepreneur’s rhythms and life through the infamous “emergency meeting.” The evening before an entrepreneur departs for a family vacation or major trade show, the M&A team will call to say that there’s been a problem with the deal and demand that he or she show up for a meeting the next day to straighten things out.

Afraid to derail the deal, the frazzled entrepreneur will cancel plans at the last minute. As a result, both the family and business team will start leaning on the owner to get the deal done. The pressure will continue to mount.

DIMINISHED PERFORMANCE

With the entrepreneur mentally checked out of the business in anticipation of the sale and worn out from missing vacations and the grind of due diligence—and the business suffering from a cutback in critical expenditures to pump up EBITDA—the business unsurprisingly suffers a temporary slump. It’s all part of the buyer’s game plan.

The corporate buyer wants the company’s performance to suffer a little so it can use it as a giant sledgehammer to drive down the price at the 59th minute of the eleventh hour.

Beat up by the entire process, the entrepreneur will begrudgingly give in to all kinds of last minute demands and concessions affecting the final price of the business.

BIDDING WARS

So what do you do to avoid this scenario—and still unload your business? First, enlist a good business broker (This is no time for amateur hour) to set up an auction for you. Don’t let a single potential buyer call the shots. One friend identified 23 strategic buyers, of which 7 came to the table to bid for the business.

As noted, Jim didn’t have this type of conversation with a broker. He didn’t understand what the offer would be. However he did get an evaluation and the broker and ABC, ended up being in the same ballpark.

If a serious prospect wants an exclusivity agreement, limit it to 30 days and require a big deposit—say $250,000—that will be forfeited if the deal isn’t completed in that window. And have “the box” of materials prepared in advance so you are bulletproof during due diligence.

Last, as best you can, insulate yourself from the transaction. Have your CFO or another trusted executive work with your broker as a go-between with the buyer, so you don’t get distracted from leading your team. Push back against last-minute demands for meetings. You want to be calm and thinking clearly every time you negotiate—and not fresh out of a fight with your spouse about cancelling the family vacation.

Overall, keep your head in the game and keep running the business as if the deal isn’t going to happen up until the moment you cash the final check!!

FREE DOWNLOAD

Aspiring to sell your business? Click here to download Gazelles White Paper “Begin with the end in Mind: Sell your Business the Right Way” which includes a list of key players to have on your team and strategies to help you sell.

Quoteworthy

"Once you recognize that the purpose of your life is not to serve yourbusiness, but that the primary purpose of your business is to serve your life, you can then go to work on our business, rather than in it, with a full understanding of why it is absolutely necessary for you to do so." -Michael Gerber, E-Myth Revisited Rule #1: Never lose Money. Rule #2: Never forget Rule #1 - Warren Buffett “Chase the vision not the money. The money will end up following you.” - Tony Hsieh, Co-Founder Zappos Positioning Systems and Gazelles coaches work with thousands of mid-market Growth companies from all over the world. Top performers commit to 3 key disciplines (habits) that both differentiate them AND lead to their consistent success: #1 They consistently apply the Four Decisions content and tools to their daily operational routines; #2 They build into their leaders’ schedules a regular, ongoing commitment to executive education (learning); and #3 They develop and utilize an ongoing accountability relationship with an outside, independent business Coach. In this newsletter we look at why training and education is so critical to growing your business:

Positioning Systems and Gazelles coaches work with thousands of mid-market Growth companies from all over the world. Top performers commit to 3 key disciplines (habits) that both differentiate them AND lead to their consistent success: #1 They consistently apply the Four Decisions content and tools to their daily operational routines; #2 They build into their leaders’ schedules a regular, ongoing commitment to executive education (learning); and #3 They develop and utilize an ongoing accountability relationship with an outside, independent business Coach. In this newsletter we look at why training and education is so critical to growing your business:

Watching my customers achieve a theme, their

Watching my customers achieve a theme, their -resized-600.jpg?width=277&height=207&name=going_up2_larger_business_richer_offers_(built_to_sell)-resized-600.jpg) show that average multiple being offered to business owners is trending upwards.

show that average multiple being offered to business owners is trending upwards.

Making good decisions in these challenging times requires leadership that listens to their employees and customers for feedback and then has the courage to change. The following is an example of one of my clients who has consistently beaten challenges and recently made a remarkable innovation that required considerable risk. First a little background on All County Music and Fred Schiff’s leadership capabilities.

Making good decisions in these challenging times requires leadership that listens to their employees and customers for feedback and then has the courage to change. The following is an example of one of my clients who has consistently beaten challenges and recently made a remarkable innovation that required considerable risk. First a little background on All County Music and Fred Schiff’s leadership capabilities. Fred intuitively understood (quoted in an article from Music Inc), “There are certain parts of the market that want to be niche, where [customers] want to experience something they can’t get somewhere else.” Investment in this innovation was $10,000 not including his stock.

Fred intuitively understood (quoted in an article from Music Inc), “There are certain parts of the market that want to be niche, where [customers] want to experience something they can’t get somewhere else.” Investment in this innovation was $10,000 not including his stock. Accessory and flute service repairs have far exceeded is projections. The initial investment has been earned back.

Accessory and flute service repairs have far exceeded is projections. The initial investment has been earned back.